FAQs

1. With the State’s fiscal challenges, how is it that the State Treasurer’s Office has an investment portfolio of $25-$30 billion? Can the Treasurer's investment portfolio be used to pay down the outstanding debts and obligations?

The Treasurer’s Office manages approximately $50 billion (as of September 2021), which includes:

- State Investments – $25 billion in pooled investment funds for state agencies, boards and commissions;

- 529 College Savings Program – $16 billion in college savings plans held by individuals and families;

- The Illinois Funds – $9 billion investment pool for state agencies and municipalities;

- ABLE Savings Program – Program for Illinois families and individuals to save for disability-related expenses; and

- Secure Choice Retirement Savings Program – Retirement savings tool for workers in Illinois that do not have access to a workplace retirement savings option.

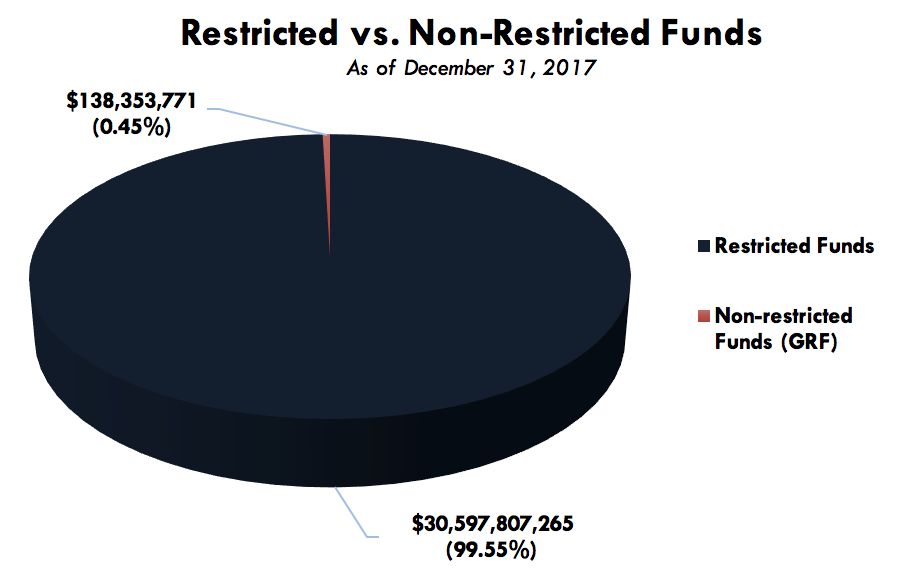

Over 99% of the Treasurer’s portfolio is restricted for predesignated purposes as mandated by state and federal law. In other words, this money cannot be spent to pay down debts and obligations. This money belongs to individuals savings for their kids’ college education, federal monies for state programs, restricted bond funding for capital projects, and Illinois’ local governments, which reflects the intentions of state law.

Under current law, only the General Revenue Fund (GRF), which totaled $138 million as of December 31, 2017, is unrestricted and as such could be used to pay down outstanding debts and obligations.

2. How much does the Treasurer’s Office return to the State in relation to its operational costs?

The Treasurer’s Office returns $42 in revenue to the state for every $1 spent in operations.

3. What is the purpose of The Vault?

The Vault is the Treasurer’s interactive open data portal. It provides ready access to a wealth of data on State financial and investment activities.

The Vault helps the Treasurer’s Office execute several important objectives:

- Transparency – Provide the people of Illinois with greater access to robust information on the Treasurer’s Office in a more user-friendly, engaging, and transparent manner;

- Civic Engagement – Foster a more informed, engaged public citizenry that actively participates in civic and public policy matters; and

- Efficiency – Generate efficiencies for the Treasurer’s Office by optimizing data preparation, storage, analysis, and reporting processes.

4. When is the State’s fiscal year?

The fiscal year for the State of Illinois starts on July 1 and ends on June 30.

- FY 2019 = July 1, 2018, to June 30, 2019

- FY 2020 = July 1, 2019, to June 30, 2020

- FY 2021 = July 1, 2020, to June 30, 2021

- FY 2022 = July 1, 2021, to June 30, 2022

- FY 2023 = July 1, 2022, to June 30, 2023

5. What is “YTD”?

“YYD” stands for year-to-date. This indicates that data is not available for the entirety of the current fiscal year but only from beginning of the fiscal year up to the current date. As a result, if you would like to compare year-over-year numbers, you must annualize these YTD figures.

6. Is there a glossary where investment and financial terminology is defined?

Yes. Please view the Glossary of Financial Terms.

7. Who is OpenGov?

OpenGov is a technology company that offers cloud-based software for public sector reporting and open data, helping empower governments to improve transparency and accountability. OpenGov provides services to the Illinois State Treasurer’s Office that enable the publication of data available on this site.

8. What should I know before downloading or distributing data from The Vault?

The Illinois State Treasurer’s Office makes available a wide array of data through this site. In addition to the policies contained on the Privacy Policy, by accessing any material on this site, users agree to the Terms of Use. Please read and understand these terms before using any data.

9. How can I ask questions, send feedback, or obtain more information?

Should you have any questions or feedback, please contact us.

Last updated: January 21, 2022